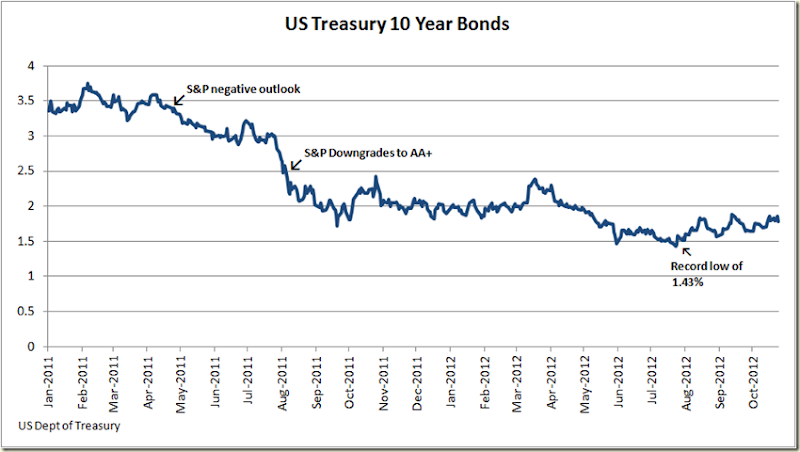

My Drum piece this week has a look at the idiocy of chasing a good credit rating, even if it puts your economic growth at risk. We’re seeing Queensland right in the midst of such a play at the moment, when given the low bond yields (record lows) worrying about what a credit rating agency thinks at the moment is pretty low on the list of things governments should worry about.

That S&P is putting WA on a negative watch says all you need to know about their worth. To recap – here was the employment growth in WA over the past 12 months:

I also had a look at UK growth versus Australia’s growth this century, to show just how horrific things are over there – and why going for austerity might not be the most wise policy of David Campbell right now:

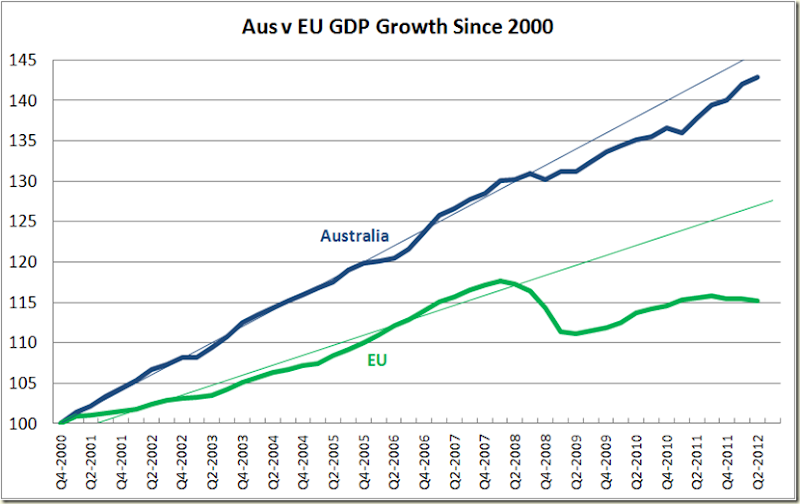

Here’s also a look at Australia versus European Union’s GDP growth:

And the USA:

Or to give it real context, let’s look at growth since the start of the GFC:

(The reason Australia's graph is shortest is because we entered the GFC later than both USA and UK).

Also interesting is that since reaching the bottom of the GFC, Australia and USA recovered at about the same pace – but the USA has been recently falling behind.

The UK on the other hand was only able to keep pace with the recovery for about a year and then flattened out. The UK has only grown 3.4% in the whole 13 quarters – over 4 years) since it began “recovering” from the GFC. To give that context, in the 4 quarters from June 2011 to July 2012 Australia grew by 3.7%

2 comments:

Excellent comparison between Australia/US/UK/EU, however the first paragraph alarms me.

Extreme care must be taken when making comparisons on bond yields between a currency-issuing government such as the US/UK/Australia/Japan/Singapore and a currency-using government such as WA/QLD/Ireland/Greece/California/Ecuador or any government guaranteeing convertibility, ie fixed exchange rates/gold standard.

Investors have great influence over bond yields of the latter. They can flee those governments en masse, investing elsewhere, putting up yields.

Investors have minimal influence over the bond yields of the former as ultimately, they cannot flee the currency or government. They can only exchange it with other investors, who then themselves have to invest that currency. And where can be safer than with the government that issues it?

In fact, the latter is so safe that currency-issuing government bond yields end up being inextricably to central bank set interest rates. As such, the government sector effectively sets its own interest rate. Australia isn't being charged higher interest on its government bonds than the UK due to investors thinking the UK is a better bet, it's simply due to our central bank setting higher interest rates.

How the two are tied is quite easy to see - if a "completely safe" investment such as bonds issued by the currency-issuer were ever yielding much higher than the central bank set interest rate, banks would buy those investments instead of lending to one another. This would put the interbank lending rate above the target cash rate by the central bank, something the central bank corrects by buying securities - notably government bonds - back off the banks, in turn lowering yields. This is why Japan/US/UK/Singapore are all receiving negative real interest rate now despite those governments carrying far more debt - simply because their respective reserve banks all have zero interest rate policies.

All that said, I agree with the sentiment. Queensland is being charged low interest today, and really shouldn't be cutting back as severely as they are. Makes far more sense to cut back during boom times, or when bond yields -do- start to appreciate - not when the economy's trying to recover from a global crisis and bond yields are low.

All good points Alex.

Post a Comment