Today’s announcement by the RBA to keep the cash rate unchanged was a bit of a shock for most predictors. Certainly the foreign exchange market didn’t see it coming, with the dollar jumping around 0.60 cents against the US dollar within minutes of the announcement being made:

Of course just because economists get a prediction wrong doesn’t mean it should be that much of a shock. But it certainly suggests a more bullish outlook from the RBA than was expected.

Of course rates are still waaaay down low:

The cash rate remains over 2 percentage points below the 20 year average, and 1.38 percentage points below the 5 year average which now covers pretty much all of the Rudd/Gillard Government.

But to discover why the RBA made no change let’s have a look at the difference between the Governor’s statements from today and last month – and I’ll highlight the differences

First Global conditions:

November:

Global growth is forecast to be a little below average for a time. Risks to the outlook are still seen to be on the downside, largely as a result of the situation in Europe, where economic activity is still contracting. Risks elsewhere seem more balanced. The United States is recording moderate growth, while recent data from China suggest growth there has stabilised. Around Asia generally, growth has been dampened by the more moderate Chinese expansion and the weakness in Europe.

October:

The outlook for growth in the world economy has softened over recent months, with estimates for global GDP being edged down, and risks to the outlook still seen to be on the downside. Economic activity in Europe is contracting, while growth in the United States remains modest. Growth in China has also slowed, and uncertainty about near-term prospects is greater than it was some months ago. Around Asia generally, growth is being dampened by the more moderate Chinese expansion and the weakness in Europe.

The only real difference is the suggestion that US growth has gone from “modest” to “moderate” and China’s growth has moved from “slowed” to “stabilised”

Since October, the USA 3rd quarter GDP figure have come out showing a 2% growth in the past 12 months:

Which I guess is “moderate’

And China’s GDP growth came in at 7.4% for the same quarter, and does shows sings of “stabilizing”:

Now to commodity prices:

November:

Key commodity prices for Australia remain significantly lower than earlier in the year, though trends have been more mixed over the past couple of months, with some prices recovering some ground while others declined further. The terms of trade have declined by about 13 per cent since the peak last year, but are likely to remain historically high.

October:

Key commodity prices for Australia remain significantly lower than earlier in the year, even though some have regained some ground in recent weeks. The terms of trade have declined by over 10 per cent since the peak last year and will probably decline further, though they are likely to remain historically high.

Here the news is all bad. In October prices seemed to have regained some ground, today however the RBA was saying the “mixed”. In October the terms of trade had declined by “over 10 per cent”, now a more specific figure is cited – that of “13 per cent”. But iron ore prices have increased since October. They’re now around $120 – up from around $100 in September.

Financial markets? Nothing at all has changed:

November:

Financial markets have responded positively over the past few months to signs of progress in addressing Europe's financial problems, but expectations for further progress remain high. Long-term interest rates faced by highly rated sovereigns, including Australia, remain at exceptionally low levels. Capital markets remain open to corporations and well-rated banks, and Australian banks have had no difficulty accessing funding, including on an unsecured basis. Borrowing conditions for large corporations are similarly attractive. Share markets have generally risen over recent months.October:

Financial markets have responded positively over the past few months to signs of progress in addressing Europe's financial problems, but expectations for further progress remain high. Low appetite for risk has seen long-term interest rates faced by highly rated sovereigns, including Australia, remain at exceptionally low levels. Nonetheless, capital markets remain open to corporations and well-rated banks, and Australian banks have had no difficulty accessing funding, including on an unsecured basis. Share markets have generally risen over recent months.

Note as well that “Capital markets remain open to corporations and well-rated banks, and Australian banks have had no difficulty accessing funding, including on an unsecured basis.” (Just in case there are still a few people around trying to sell you the whole “the Govt’s debt is crowding out investors” theory.)

Now to domestic conditions.

Once again there has been next to no change in the labour market or in general growth since October. The RBA changed around the paragraphs a bit, but the wordage is the same:

November:

In Australia, most indicators available for this meeting suggest that growth has been running close to trend over the past year, led by very large increases in capital spending in the resources sector. Looking ahead, the peak in resource investment is likely to occur next year, at a lower level than expected six months ago. As this peak approaches, the Board will be monitoring the strength of other components of demand.Some of the consumption strength in the first half of 2012 was temporary, but there have been some signs of ongoing growth, though a return to very strong growth in consumption is unlikely. While investment in dwellings has been subdued for some time, over recent months there have been some indications of a prospective improvement. Non-residential building investment has remained weak. Public spending is forecast to be subdued.

October:

In Australia, most indicators available for this meeting suggest that growth has been running close to trend, led by very large increases in capital spending in the resources sector. Consumption growth was quite firm in the first half of 2012, though some of that strength was temporary. Investment in dwellings has remained subdued, though there have been some tentative signs of improvement, while non-residential building investment has also remained weak. Looking ahead, the peak in resource investment is likely to occur next year, and may be at a lower level than earlier expected. As this peak approaches it will be important that the forecast strengthening in some other components of demand starts to occur.

Now we get to the big difference – inflation.

November:

Recent outcomes on inflation were slightly higher than expected, though they still show inflation consistent with the medium-term target, with underlying measures around 2½ per cent over the year to September, and headline CPI inflation a little lower than that. The introduction of the carbon price affected consumer prices in the September quarter, and there could be some further small effects over the next couple of quarters. With the labour market having generally softened somewhat in recent months, and unemployment edging higher, conditions should work to contain pressure on labour costs in sectors other than those directly affected by the current strength in resources. This and some continuing improvement in productivity performance will be needed to keep inflation low, since the effects on prices of the earlier exchange rate appreciation are now waning. The Bank's assessment remains that inflation will be consistent with the target over the next one to two years.

October:

Labour market data have shown moderate employment growth and the rate of unemployment has thus far remained low. The Bank's assessment, though, is that the labour market has generally softened somewhat in recent months.

Inflation has been low, with underlying measures near 2 per cent over the year to June, and headline CPI inflation lower than that. The introduction of the carbon price is affecting consumer prices in the current quarter, and this will continue over the next couple of quarters. Moderate labour market conditions should work to contain pressure on labour costs in sectors other than those directly affected by the current strength in resources. This and some continuing improvement in productivity performance will be needed to keep inflation low as the effects of the earlier exchange rate appreciation wane. The Bank's assessment remains, at this point, that inflation will be consistent with the target over the next one to two years.

In October the underlying measures were “near 2 per cent”; in November it was “around 2 1/2 per cent”. That difference was the key reason why the RBA held off dropping rates- they don’t want to be seen dropping rates while inflation possibly might be increasing unless the other signs in the economy (both here and abroad) are all negative. .

It agrees with what I suggested when the last CPI numbers came out, where I wrote:

The only aspect I think that might get the RBA to pause and not cut rates on Cup Day is that given the past 6 months has seen a combined 1.5% increase in the weighted median and a 1.3% rise in the trimmed mean the RBA might think that annualizes out to around the 3.0% – ie a the top on the band and thus decide it is best to wait and see what the December quarter holds before cutting the rates.

Not that this makes me a genius – I still predicted a cut in rates!

Now on to the conclusion, and a look at where the RBA sees monetary policy at the moment:

November:

Over the past year, monetary policy has become more accommodative. Interest rates for borrowers have declined to be clearly below their medium-term averages and savers are facing increased incentives to look for assets with higher returns. While the impact of these changes takes some time to work through the economy, there are signs of easier conditions starting to have some of the expected effects. Business demand for external funding has increased this year, the housing market has strengthened and share prices have risen in line with markets overseas. The exchange rate, though, remains higher than might have been expected, given the observed decline in export prices and the weaker global outlook.

October:

Interest rates for borrowers have for some months been a little below their medium-term averages. There are tentative signs of this starting to have some of the expected effects, though the impact of monetary policy changes takes some time to work through the economy. However, credit growth has softened of late and the exchange rate has remained higher than might have been expected, given the observed decline in export prices and the weaker global outlook.

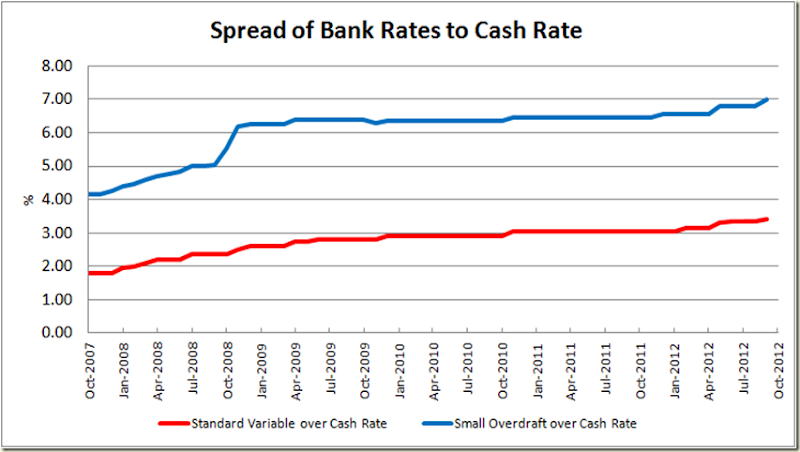

They have changed from thinking rates are “a little below” to “clearly below” medium-term averages. With regards to home loans they are right, but with respect to small businesses, the rates remain slightly above average:

On this point it is worth noting that the spread of the cash rate to the small business overdraft rate actually increased in the past month:

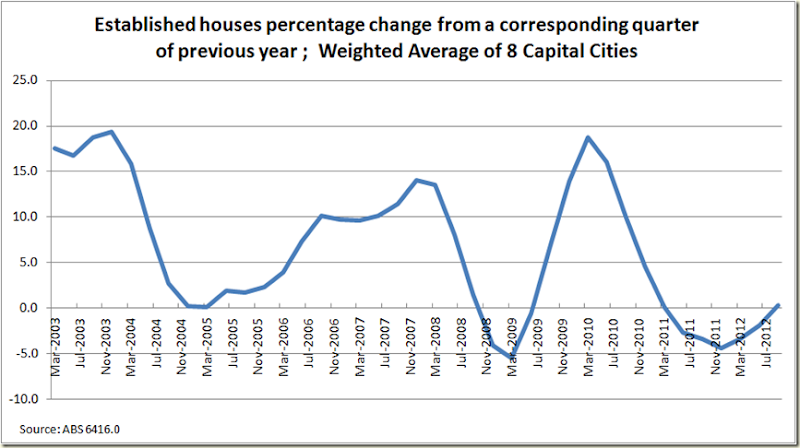

It also mentioned housing prices which brings us to the House Price Index data released today by the ABS, that showed a 0.3% annual growth across the capital cities.

So not exactly a housing price boom, but I guess it has “strengthened” (given anything positive is stronger than negative).

Now to the end:

November:

Further effects of actions already taken to ease monetary policy can be expected over time. The Board will continue to monitor those effects, together with information about the various other factors affecting the outlook for growth and inflation. At today's meeting, with prices data slightly higher than expected and recent information on the world economy slightly more positive, the Board judged that the stance of monetary policy was appropriate for the time being.

October:

At today's meeting, the Board judged that, on the back of international developments, the growth outlook for next year looked a little weaker, while inflation was expected to be consistent with the target. The Board therefore decided that it was appropriate for the stance of monetary policy to be a little more accommodative.

The big differences – the higher than expected inflation data and the “slightly more positive” world economy (seriously, they must have been turning up the rose coloured glasses to “blinding” to think the world economy is more positive on the basis of China and the USA GDP growth.

And there the cash rate rests. Until December – at which point the market still expects there is a slightly better than even chance the RBA will drop rates to 3%.

2 comments:

Line 2, jumping "60 cents"?

Ahem...

Yeah whoops. Cheers, fixed now. (and cheers as well to everyone on Twitter for letting me know!)

Post a Comment